Target Rate Of Return On Investment - How To Prove Social Media Roi Includes A Free Calculator : $7, 200 $25, 920 $200,000 $720,000

Target Rate Of Return On Investment - How To Prove Social Media Roi Includes A Free Calculator : $7, 200 $25, 920 $200,000 $720,000. According to the s&p 500 index, the average return on investment in the us real estate market is 8.6%. Quarter, above company average return on investment. B) the boat division is financially more successful than the trailer division because it shows an Residential real estate has an average roi of 10.6%, commercial real estate has an average return on investment of 9.5%, and reits have an average return of 11.8%. Enter your state, investment amount, and term to find the highest rates & best guarantees

Mathematically, the growth of your investments can't be calculated without it. However, investors made 5.19% on their investments. When calculating the rate of return on a rental property using the cap rate calculation, many real estate experts agree that a good roi is usually around 10%, and a great one is 12% or more. Powell enterprises has operating income of $72,000. Arr may be compared with the target return on investment.

In terms of decision making, if the arr is equal to or greater than a company's required rate of return hurdle rate definition a hurdle rate, which is also known as minimum acceptable rate of return (marr), is the minimum required rate of return or target rate that investors are expecting to receive on an investment.

Common reasons why investors lose more often than they should is because: So if the inflation rate was 1% in a year with a 7% return, then the. The average rate of return for the s&p 500 index was 9.85% between the years 1995 and 2015. For instance, if your net profit is $50,000, and your total assets are $200,000, your roi would be 25 percent. Residential real estate has an average roi of 10.6%, commercial real estate has an average return on investment of 9.5%, and reits have an average return of 11.8%. Return on investment (roi) is a financial concept that measures the profitability of an investment. But your 401(k) return depends on different factors like your contributions, investment selection and fees. Investments may be accepted if the arr exceeds the target return. Internal rate of return and return on investment stop being equal after year 1. Mathematically, the growth of your investments can't be calculated without it. The minimum required real portfolio return that you are solving for is the rate that, in 25 years makes the future value of your current savings and your expected annual savings equal to your accumulation target of $968,662. According to the s&p 500 index, the average return on investment in the us real estate market is 8.6%. The process starts by defining a specific return desired for the investment being made.

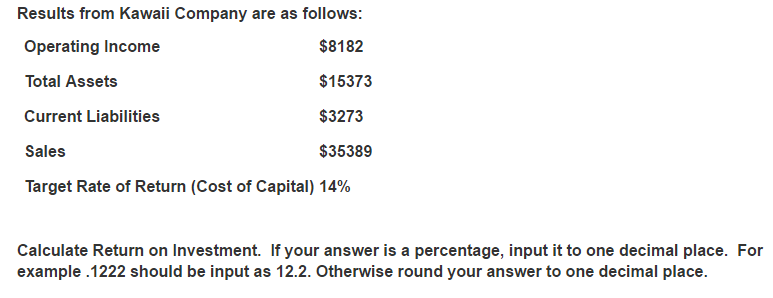

There are the highest guaranteed returns for savers. Target corp achieved return on average invested assets of 15.65 % in iv. There are several methods to determine roi, but the most common is to divide net profit by total assets. A) 14% b) 4% c) 45% d) 10%. B) the boat division is financially more successful than the trailer division because it shows an

To calculate the cap rate for an investment property, take the property's net operating income and divide it by the property's market value.

Quarter, above company average return on investment. A rate of return (ror) is the gain or loss of an investment over a certain period of time. Your irr in year 2 is again 10%—your portfolio grew by 10% within the year. Within retail sector 23 other companies have achieved higher return on investment. The average return on investment differs based on property investment strategies. To calculate the cap rate for an investment property, take the property's net operating income and divide it by the property's market value. The minimum required real portfolio return that you are solving for is the rate that, in 25 years makes the future value of your current savings and your expected annual savings equal to your accumulation target of $968,662. Return on investment (roi) is a financial concept that measures the profitability of an investment. Generally, the average rate of return on investment is anything above 15%. Enter your state, investment amount, and term to find the highest rates & best guarantees Mathematically, the growth of your investments can't be calculated without it. For a property you might buy, use the expected purchase. It is equal to the profit that an investor expects from his investment.

When calculating the rate of return on a rental property using the cap rate calculation, many real estate experts agree that a good roi is usually around 10%, and a great one is 12% or more. What the firm expects from the investments made in the venture. To calculate the cap rate for an investment property, take the property's net operating income and divide it by the property's market value. Common reasons why investors lose more often than they should is because: So to accurately calculate return on investment, we need to understand the full return.

:max_bytes(150000):strip_icc()/dotdash_Final_A_Guide_to_Calculating_Return_on_Investment_ROI_Aug_2020-01-82c5e4327e174fab8b2905ea7220417d.jpg)

Your target return price should be equal to the profit that an investor expects from their investment.

Given that target roi, financial calculations are made to determine the price that would need to be charged. To calculate the cap rate for an investment property, take the property's net operating income and divide it by the property's market value. There are several methods to determine roi, but the most common is to divide net profit by total assets. Your irr in year 2 is again 10%—your portfolio grew by 10% within the year. There are the highest guaranteed returns for savers. A) 14% b) 4% c) 45% d) 10%. A company's invested capital is $13,000,000 and management has determined that the target rate of return on investment is 10%. Target corp achieved return on average invested assets of 15.65 % in iv. Date ttm net income lt investments & debt return on investment; 2) in a _____, the manager is responsible for generating revenues and controlling costs. Enter your state, investment amount, and term to find the highest rates & best guarantees A target return refers to the future price that an investor expects from capital invested in a company. Furthermore, your target rate of return determines which opportunities make sense for you.

Komentar

Posting Komentar